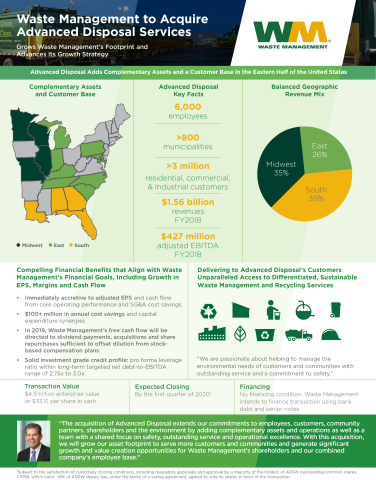

Waste Management to Acquire Advanced Disposal for $4.9 Billion Adding Complementary Assets and Customer Base in the Eastern United States

- Expected to be Immediately Accretive to Waste Management’s Earnings and Cash Flow

-

More than

$100 Million of Projected Annual Cost and Capital Expenditure Synergies Expected to Result in a Post-Synergy Transaction Multiple Well Below Waste Management's Current Trading Multiple - Joins Dedicated and Experienced Teams with Shared Commitments to Safety, Outstanding Customer Service and Operating Excellence

- Both Waste Management and Advanced Disposal Remain Confident in the Strength of their Businesses and Expect to Achieve Previously Announced Full-Year Guidance, Excluding Transaction-Related Considerations

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20190415005336/en/

Waste Management to Acquire Advanced Disposal (Graphic: Business Wire)

Waste Management is North America’s premier environmental solutions

company. This acquisition grows Waste Management’s footprint and allows

Waste Management to deliver to Advanced Disposal customers unparalleled

access to differentiated, sustainable waste management and recycling

services. With 2018 revenues of

“At Waste Management, we focus on creating value for all stakeholders,

delivering on our commitments to employees, customers, community

partners, shareholders and the environment. The acquisition of Advanced

Disposal extends these commitments by adding complementary assets and

operations as well as a team with a shared focus on safety, outstanding

service and operational excellence,” said

“We are pleased to have reached this milestone agreement with Waste

Management to deliver an immediate cash premium to Advanced Disposal

stockholders. We view Waste Management as an industry leader with one of

the most respected brands in the nation,” said

Compelling Strategic and Financial Benefits

The acquisition advances Waste Management’s growth strategy and aligns with the Company’s financial goals, including growth in earnings per share, margins, and cash flow. Specifically, Waste Management expects the addition of Advanced Disposal to:

- Expand Waste Management’s Footprint and Customer Base. This acquisition brings a high-quality, complementary asset network and customer base under Waste Management’s proven management team, who has a track record of operational excellence and a demonstrated ability to grow the margins and cash flows of the assets Waste Management has acquired.

- Create Significant Synergies and Grow Waste Management’s Earnings

and Cash Flows. Waste Management expects the transaction to

generate more than

$100 million in annual cost and capital expenditure synergies. The Advanced Disposal acquisition will be immediately accretive to Waste Management’s adjusted earnings per share and cash flow, with near-term benefits expected from core operating performance and SG&A cost savings. Incremental benefits from operating and capital efficiencies and network optimization will drive long-term margin expansion and improved free cash flow conversion. - Support Waste Management’s Capital Allocation Priorities. Waste Management’s strong balance sheet and significant free cash flow generation position it well to fund the acquisition. In 2019, Waste Management’s free cash flow will be directed to dividend payments, acquisitions and share repurchases sufficient to offset dilution from stock-based compensation plans. The Advanced Disposal acquisition will enhance Waste Management’s cash flow growth and support its commitment to grow shareholder returns. Waste Management currently expects to achieve targeted leverage and return to normal run-rate share repurchases within one year of the acquisition’s close.

- Continue a Commitment to Outstanding Customer Service and Sustainable Waste Solutions. The acquisition will join two teams of dedicated employees who are passionate about helping to manage the environmental needs of customers and communities with outstanding service and a commitment to safety. Waste Management expects to continue making investments in employees, technology, and capital equipment to further grow the business, and ensure superior, reliable customer service, and generate strong returns.

Financing

The transaction is not subject to a financing condition. Waste Management intends to finance the transaction using a combination of bank debt and senior notes.

Following completion of the transaction, Waste Management expects to maintain a strong balance sheet and solid investment grade credit profile with a pro forma leverage ratio within the Company’s long-term targeted net debt-to-EBITDA range of 2.75x to 3.0x.

Timing and Approvals

The transaction, which was unanimously approved by the boards of directors of both companies, is expected to close by the first quarter of 2020, subject to the satisfaction of customary closing conditions, including regulatory approvals and approval by a majority of the holders of Advanced Disposal’s outstanding common shares.

In connection with the definitive agreement, Canada Pension Plan Investment Board, which owns approximately 19% of Advanced Disposal’s outstanding shares, has, under the terms of a voting agreement, agreed to vote its shares in favor of the transaction.

Companies Confirm 2019 Guidance and Waste Management Confirms Schedule for Upcoming First Quarter 2019 Earnings Call

Both Waste Management and Advanced Disposal remain confident in the strength of their businesses and expect to achieve previously announced full-year guidance, excluding transaction-related considerations.

As previously announced, Waste Management will release its first quarter

2019 financial results before the opening of the market on

Advanced Disposal will release its first quarter 2019 financial results

on

Advisors

ABOUT WASTE MANAGEMENT

Waste Management, based in Houston,

ABOUT ADVANCED DISPOSAL

Advanced Disposal, based in Ponte Vedra,

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This press release contains “forward-looking statements” within the

meaning of the U.S. federal securities laws about Waste Management,

Advanced Disposal and the proposed acquisition, including but not

limited to all statements about the timing and approvals of the proposed

acquisition; ability to consummate and finance the acquisition;

integration of the acquisition; future operations; future capital

allocation; future business and financial performance of Waste

Management and Advanced Disposal and the ability to achieve full year

financial guidance; future leverage ratio; and all outcomes of the

proposed acquisition, including synergies, cost savings, and impact on

earnings, cash flow and margin, return on capital, strength of the

balance sheet and credit ratings, which are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act of

1995. Words such as “expect,” “likely,” “outlook,” “forecast,”

“preliminary,” “would,” “could,” “should,” “can,” “will,” “project,”

“intend,” “plan,” “goal,” “guidance,” “target,” “continue,” “sustain, “

“synergy,” “on track,” “believe,” “seek,” “estimate,” “anticipate,”

“may,” “possible,” “assume,” and variations of such words and similar

expressions are intended to identify such forward-looking statements.

You should view these statements with caution and should not place undue

reliance on such statements. They are based on the facts and

circumstances known to Waste Management and Advanced Disposal (as the

case may be) as of the date the statements are made. These

forward-looking statements are subject to risks and uncertainties that

could cause actual results to be materially different from those set

forth in such forward-looking statements, including but not limited to,

general economic and capital markets conditions; the effects that the

announcement or pendency of the merger may have on Waste Management,

Advanced Disposal and their respective business; inability to obtain

required regulatory or government approvals or to obtain such approvals

on satisfactory conditions; inability to obtain stockholder approval or

satisfy other closing conditions; inability to obtain financing; the

occurrence of any event, change or other circumstance that could give

rise to the termination of the definitive agreement; the effects that

any termination of the definitive agreement may have on Advanced

Disposal or its business; legal proceedings that may be instituted

related to the proposed acquisition; unexpected costs, charges or

expenses; failure to successfully integrate the acquisition, realize

anticipated synergies or obtain the results anticipated; and other risks

and uncertainties described in Waste Management’s and Advanced

Disposal’s filings with the

NON-GAAP FINANCIAL MEASURES

Advanced Disposal’s 2018 adjusted EBITDA is a non-GAAP measure. Please

see Advanced Disposal’s press release and accompanying tables dated

Waste Management’s references to future adjusted earnings per diluted

share and free cash flow are non-GAAP measures. Please see the notes to

Waste Management’s press release dated

For purposes of the pro forma leverage ratio, all terms used in that

calculation, including EBITDA, are defined in Waste Management’s

Revolving Credit Agreement filed with the

ADDITIONAL INFORMATION AND WHERE TO FIND IT

This communication does not constitute an offer to sell or the

solicitation of an offer to buy any securities or a solicitation of any

vote or approval. This communication may be deemed to be solicitation

material in respect of the proposed merger between a subsidiary of Waste

Management and Advanced Disposal. Advanced Disposal intends to file with

the

CERTAIN INFORMATION CONCERNING PARTICIPANTS

Advanced Disposal and its directors and executive officers may be deemed

to be participants in the solicitation of proxies from Advanced Disposal

stockholders in connection with the contemplated transaction.

Information about Advanced Disposal’s directors and executive officers

is set forth in its proxy statement for its 2019 Annual Meeting of

Stockholders, which may be obtained for free at the SEC’s website at www.sec.gov.

Additional information regarding the interests of participants in the

solicitation of proxies in connection with the contemplated transactions

will be included in the proxy statement that Advanced Disposal intends

to file with the

View source version on businesswire.com: https://www.businesswire.com/news/home/20190415005336/en/

Source:

Waste Management

Web site

https://www.wm.com

Analysts

Ed

Egl

713.265.1656

eegl@wm.com

Media

Tiffiany

Moehring

720.346.5372

tmoehrin@wm.com

Advanced

Disposal

Website

https://www.advanceddisposal.com

Analysts

& Media

Matthew Nelson 904.737.7900

matthew.nelson@advanceddisposal.com