Waste Management Announces Second Quarter Earnings

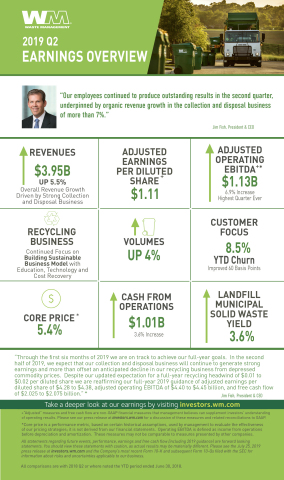

Strength of Collection and Disposal Business Drives Overall Revenue Growth of More Than 5%

Company Reaffirms Guidance

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20190725005367/en/

2019 Q2 Earnings Overview (Graphic: Business Wire)

The Company’s adjusted second quarter of 2019 results exclude: a

The Company’s adjusted second quarter of 2018 results exclude a

“Our employees continued to produce outstanding results in the second quarter, underpinned by organic revenue growth in the collection and disposal business of more than 7%,” said

KEY HIGHLIGHTS FOR THE SECOND QUARTER OF 2019

Profitability

Total Company operating EBITDA was$1.11 billion for the second quarter of 2019, an increase of$6 million from the second quarter of 2018.(c) On an adjusted basis, total Company operating EBITDA was $1.13 billion for the second quarter of 2019, an increase of $73 million, or 6.9%, from the second quarter of 2018.(b)- Operating EBITDA in the Company’s collection and disposal business increased

$112 million , or 9.3%, in the second quarter of 2019 when compared to the second quarter of 2018.

Revenue Growth

- In the second quarter of 2019, revenue growth was driven by strong yield and volume growth in the Company’s collection and disposal business, which contributed

$230 million of incremental revenue. This was partially offset by a$38 million year-over-year decline in revenue from the Company’s recycling line of business. - Core price for the second quarter of 2019 was 5.4%, compared to 5.3% in the second quarter of 2018.(d)

- Internal revenue growth from yield for the collection and disposal business was 2.7% for the second quarter of 2019 versus 2.3% in the second quarter of 2018.

- Collection and disposal business internal revenue growth from volume was 4.4% in the second quarter of 2019.

Total Company internal revenue growth from volume, which includes the Company’s recycling line of business, was 4.0% in the second quarter of 2019.

Recycling

- Operating EBITDA in the Company’s recycling line of business improved by

$6 million compared to the second quarter of 2018, despite a$38 million decline in revenue. The Company was able to overcome pressure from a 33% year-over-year drop in recycling commodity prices by working to develop a sustainable business model that also meets customers’ environmental needs. - The Company now expects the recycling business to be a

$0.01 to $0.02 per diluted share headwind in 2019 compared to 2018, due to continued expected weakness in recycling commodity prices.

Cost Management

- As a percentage of revenue, operating expenses were 61.9% in the second quarter of both 2019 and 2018. On an adjusted basis, operating expenses were 61.5% for the second quarter of 2019.(b)

- As a percentage of revenue, SG&A expenses were 9.9%, or 9.8% on an adjusted basis, in the second quarter of 2019 compared to 9.8% in the second quarter of 2018.(b)

Free Cash Flow & Capital Allocation

- Net cash provided by operating activities was

$1.01 billion in the second quarter of 2019, an increase of$35 million , or 3.6%, when compared to the second quarter of 2018. The growth in net cash provided by operating activities was driven by operating EBITDA growth and the Company’s focus on improving working capital, partially offset by higher taxes and interest. - Capital expenditures were

$578 million in the second quarter of 2019, a$142 million increase from the second quarter of 2018, due to an intentional focus on accelerating certain fleet and landfill spending to support the Company’s strong collection and disposal growth. - Free cash flow was

$440 million in the second quarter of 2019 compared to$621 million in the second quarter of 2018.(b) The decline in free cash flow was primarily driven by the increase in capital expenditures in the quarter attributable to year-over-year timing differences in fleet and landfill spending and a reduction in proceeds from divestitures. - The Company paid

$217 million of dividends to shareholders and repurchased$180 million of its shares in the second quarter of 2019. - The Company spent

$48 million on acquisitions of traditional solid waste businesses during the second quarter of 2019.

Taxes

- The Company’s effective tax rate for the second quarter of 2019 was approximately 23.3%.

Fish concluded, “Through the first six months of 2019 we are on track to achieve our full-year goals. In the second half of 2019, we expect that our collection and disposal business will continue to generate strong earnings and more than offset an anticipated decline in our recycling business from depressed commodity prices. Despite our updated expectation for a full-year recycling headwind of

|

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- |

|

|

(a) |

For purposes of this press release, all references to “Net income” refer to the financial statement line item “Net income attributable to Waste Management, Inc.” |

|

|

|

|

(b) |

Adjusted earnings per diluted share, adjusted net income, adjusted operating EBITDA, adjusted operating expenses, adjusted SG&A expenses and free cash flow are non-GAAP measures. Please see “Non-GAAP Financial Measures” below and the reconciliations in the accompanying schedules for more information. |

|

|

|

|

(c) |

Management defines operating EBITDA as GAAP income from operations before depreciation and amortization; this measure may not be comparable to similarly-titled measures reported by other companies. |

|

|

|

|

(d) |

Core price consists of price increases net of rollbacks and fees, excluding the Company’s fuel surcharge. It is a performance metric used by management to evaluate the effectiveness of our pricing strategies; it is not derived from our financial statements and may not be comparable to measures presented by other companies. Core price is based on certain historical assumptions, which may differ from actual results, to allow for comparability between reporting periods and to reveal trends in results over time. |

The Company will host a conference call at

The conference call will be webcast live from the Investor Relations section of Waste Management’s website www.wm.com. To access the conference call by telephone, please dial (877) 710-6139 approximately 10 minutes prior to the scheduled start of the call. If you are calling from outside of

A replay of the conference call will be available on the Company’s website www.wm.com and by telephone from approximately

ABOUT WASTE MANAGEMENT

Waste Management, based in

FORWARD-LOOKING STATEMENTS

The Company, from time to time, provides estimates of financial and other data, comments on expectations relating to future periods and makes statements of opinion, view or belief about current and future events. This press release contains a number of such forward-looking statements, including but not limited to statements regarding 2019 earnings per diluted share; 2019 operating EBITDA; 2019 free cash flow; and all statements regarding future performance of our collection and disposal business, recycling business or otherwise. You should view these statements with caution. They are based on the facts and circumstances known to the Company as of the date the statements are made. These forward-looking statements are subject to risks and uncertainties that could cause actual results to be materially different from those set forth in such forward-looking statements, including but not limited to, increased competition; pricing actions; failure to implement our optimization, growth, and cost savings initiatives and overall business strategy; failure to identify acquisition targets and negotiate attractive terms; failure to consummate or integrate the acquisition of

NON-GAAP FINANCIAL MEASURES

To supplement its financial information, the Company, in some instances, has presented adjusted earnings per diluted share, adjusted net income, adjusted operating EBITDA, adjusted operating expenses, adjusted SG&A expenses and free cash flow, and has also presented projections of adjusted earnings per diluted share, adjusted operating EBITDA, and free cash flow; these are non-GAAP financial measures, as defined in Regulation G of the Securities Exchange Act of 1934, as amended. The Company reports its financial results in compliance with GAAP but believes that also discussing non-GAAP measures provides investors with (i) additional, meaningful comparisons of current results to prior periods’ results by excluding items that the Company does not believe reflect its fundamental business performance and are not representative or indicative of its results of operations and (ii) financial measures the Company uses in the management of its business.

The Company’s projected full year 2019 earnings per diluted share, and operating EBITDA are anticipated to exclude the effects of events or circumstances in 2019 that are not representative or indicative of the Company’s results of operations. Such excluded items are not currently determinable, but may be significant, such as asset impairments and one-time items, charges, gains or losses from divestitures or litigation, and other items, including transaction costs related to the pending acquisition of

The Company discusses free cash flow because the Company believes that it is indicative of its ability to pay its quarterly dividends, repurchase common stock, fund acquisitions and other investments and, in the absence of refinancings, to repay its debt obligations. Free cash flow is not intended to replace “Net cash provided by operating activities,” which is the most comparable GAAP measure. The Company believes free cash flow gives investors useful insight into how the Company views its liquidity, but the use of free cash flow as a liquidity measure has material limitations because it excludes certain expenditures that are required or that the Company has committed to, such as declared dividend payments and debt service requirements. The Company defines free cash flow as net cash provided by operating activities, less capital expenditures, plus proceeds from divestitures of businesses and other assets (net of cash divested); this definition may not be comparable to similarly-titled measures reported by other companies.

The quantitative reconciliations of non-GAAP measures used herein to the most comparable GAAP measures are included in the accompanying schedules, with the exception of projected earnings per diluted share and projected operating EBITDA. Non-GAAP measures should not be considered a substitute for financial measures presented in accordance with GAAP.

|

WASTE MANAGEMENT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (In Millions, Except per Share Amounts) (Unaudited) |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Six Months Ended |

||||||||

|

|

|

June 30, |

|

June 30, |

||||||||

|

|

|

2019 |

|

2018 |

|

2019 |

|

2018 |

||||

|

Operating revenues |

|

$ |

3,946 |

|

$ |

3,739 |

|

$ |

7,642 |

|

$ |

7,250 |

|

Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating |

|

|

2,443 |

|

|

2,313 |

|

|

4,741 |

|

|

4,497 |

|

Selling, general and administrative |

|

|

391 |

|

|

365 |

|

|

800 |

|

|

738 |

|

Depreciation and amortization |

|

|

409 |

|

|

384 |

|

|

775 |

|

|

731 |

|

Restructuring |

|

|

— |

|

|

1 |

|

|

2 |

|

|

3 |

|

(Gain) loss from divestitures, asset impairments and unusual items, net |

|

|

7 |

|

|

(39) |

|

|

7 |

|

|

(42) |

|

|

|

|

3,250 |

|

|

3,024 |

|

|

6,325 |

|

|

5,927 |

|

Income from operations |

|

|

696 |

|

|

715 |

|

|

1,317 |

|

|

1,323 |

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

|

(100) |

|

|

(93) |

|

|

(196) |

|

|

(184) |

|

Loss on early extinguishment of debt |

|

|

(84) |

|

|

— |

|

|

(84) |

|

|

— |

|

Equity in net losses of unconsolidated entities |

|

|

(16) |

|

|

(13) |

|

|

(25) |

|

|

(20) |

|

Other, net |

|

|

1 |

|

|

— |

|

|

(53) |

|

|

1 |

|

|

|

|

(199) |

|

|

(106) |

|

|

(358) |

|

|

(203) |

|

Income before income taxes |

|

|

497 |

|

|

609 |

|

|

959 |

|

|

1,120 |

|

Income tax expense |

|

|

115 |

|

|

110 |

|

|

230 |

|

|

226 |

|

Consolidated net income |

|

|

382 |

|

|

499 |

|

|

729 |

|

|

894 |

|

Less: Net income (loss) attributable to noncontrolling interests |

|

|

1 |

|

|

— |

|

|

1 |

|

|

(1) |

|

Net income attributable to Waste Management, Inc. |

|

$ |

381 |

|

$ |

499 |

|

$ |

728 |

|

$ |

895 |

|

Basic earnings per common share |

|

$ |

0.90 |

|

$ |

1.16 |

|

$ |

1.71 |

|

$ |

2.07 |

|

Diluted earnings per common share |

|

$ |

0.89 |

|

$ |

1.15 |

|

$ |

1.70 |

|

$ |

2.06 |

|

Weighted average basic common shares outstanding |

|

|

424.8 |

|

|

429.9 |

|

|

424.6 |

|

|

431.6 |

|

Weighted average diluted common shares outstanding |

|

|

427.5 |

|

|

432.3 |

|

|

427.2 |

|

|

434.1 |

|

WASTE MANAGEMENT, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS (In Millions) (Unaudited) |

||||||

|

|

|

|

|

|

|

|

|

|

|

June 30, |

|

December 31, |

||

|

|

|

2019 |

|

2018 |

||

|

ASSETS |

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

2,250 |

|

$ |

61 |

|

Receivables, net |

|

|

2,260 |

|

|

2,275 |

|

Other |

|

|

326 |

|

|

309 |

|

Total current assets |

|

|

4,836 |

|

|

2,645 |

|

Property and equipment, net |

|

|

12,665 |

|

|

11,942 |

|

Goodwill |

|

|

6,512 |

|

|

6,430 |

|

Other intangible assets, net |

|

|

547 |

|

|

572 |

|

Other |

|

|

1,426 |

|

|

1,061 |

|

Total assets |

|

$ |

25,986 |

|

$ |

22,650 |

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

Accounts payable, accrued liabilities and deferred revenues |

|

$ |

2,730 |

|

$ |

2,676 |

|

Current portion of long-term debt |

|

|

116 |

|

|

432 |

|

Total current liabilities |

|

|

2,846 |

|

|

3,108 |

|

Long-term debt, less current portion |

|

|

12,623 |

|

|

9,594 |

|

Other |

|

|

4,050 |

|

|

3,672 |

|

Total liabilities |

|

|

19,519 |

|

|

16,374 |

|

Equity: |

|

|

|

|

|

|

|

Waste Management, Inc. stockholders’ equity |

|

|

6,466 |

|

|

6,275 |

|

Noncontrolling interests |

|

|

1 |

|

|

1 |

|

Total equity |

|

|

6,467 |

|

|

6,276 |

|

Total liabilities and equity |

|

$ |

25,986 |

|

$ |

22,650 |

|

WASTE MANAGEMENT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (In Millions) (Unaudited) |

||||||

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended |

||||

|

|

|

June 30, |

||||

|

|

|

2019 |

|

2018 |

||

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

Consolidated net income |

|

$ |

729 |

|

$ |

894 |

|

Adjustments to reconcile consolidated net income to net cash provided by operating activities: |

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

775 |

|

|

731 |

|

Loss on early extinguishment of debt |

|

|

84 |

|

|

— |

|

Other |

|

|

195 |

|

|

57 |

|

Change in operating assets and liabilities, net of effects of acquisitions and divestitures |

|

|

117 |

|

|

102 |

|

Net cash provided by operating activities |

|

|

1,900 |

|

|

1,784 |

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

Acquisitions of businesses, net of cash acquired |

|

|

(440) |

|

|

(263) |

|

Capital expenditures |

|

|

(1,049) |

|

|

(836) |

|

Proceeds from divestitures of businesses and other assets (net of cash divested) |

|

|

20 |

|

|

96 |

|

Other, net |

|

|

(96) |

|

|

(7) |

|

Net cash used in investing activities |

|

|

(1,565) |

|

|

(1,010) |

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

New borrowings |

|

|

3,971 |

|

|

83 |

|

Debt repayments |

|

|

(385) |

|

|

(196) |

|

Premiums paid on early extinguishment of debt |

|

|

(84) |

|

|

— |

|

Net commercial paper borrowings (repayments) |

|

|

(1,001) |

|

|

443 |

|

Common stock repurchase program |

|

|

(248) |

|

|

(550) |

|

Cash dividends |

|

|

(440) |

|

|

(406) |

|

Exercise of common stock options |

|

|

45 |

|

|

33 |

|

Tax payments associated with equity-based compensation transactions |

|

|

(30) |

|

|

(28) |

|

Other, net |

|

|

(6) |

|

|

(26) |

|

Net cash provided by (used in) financing activities |

|

|

1,822 |

|

|

(647) |

|

Effect of exchange rate changes on cash, cash equivalents and restricted cash and cash equivalents |

|

|

2 |

|

|

(1) |

|

Increase (decrease) in cash, cash equivalents and restricted cash and cash equivalents |

|

|

2,159 |

|

|

126 |

|

Cash, cash equivalents and restricted cash and cash equivalents at beginning of period |

|

|

183 |

|

|

293 |

|

Cash, cash equivalents and restricted cash and cash equivalents at end of period |

|

$ |

2,342 |

|

$ |

419 |

|

WASTE MANAGEMENT, INC.

SUMMARY DATA SHEET (In Millions) (Unaudited) |

||||||||||||||||||||

|

Operating Revenues by Line of Business |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

Three Months Ended |

|

Six Months Ended |

||||||||||||||||

|

|

|

June 30, |

|

June 30, |

||||||||||||||||

|

|

|

2019 |

|

2018 |

|

2019 |

|

2018 |

||||||||||||

|

Commercial |

|

$ |

|

1,052 |

|

|

$ |

|

986 |

|

|

$ |

|

2,078 |

|

|

$ |

|

1,941 |

|

|

Residential |

|

|

655 |

|

|

|

632 |

|

|

|

1,295 |

|

|

|

1,246 |

|

||||

|

Industrial |

|

|

744 |

|

|

|

708 |

|

|

|

1,424 |

|

|

|

1,345 |

|

||||

|

Other |

|

|

122 |

|

|

|

115 |

|

|

|

231 |

|

|

|

216 |

|

||||

|

Total collection |

|

|

2,573 |

|

|

|

2,441 |

|

|

|

5,028 |

|

|

|

4,748 |

|

||||

|

Landfill |

|

|

1,023 |

|

|

|

915 |

|

|

|

1,887 |

|

|

|

1,720 |

|

||||

|

Transfer |

|

|

474 |

|

|

|

437 |

|

|

|

886 |

|

|

|

812 |

|

||||

|

Recycling |

|

|

264 |

|

|

|

305 |

|

|

|

555 |

|

|

|

617 |

|

||||

|

Other |

|

|

445 |

|

|

|

439 |

|

|

|

876 |

|

|

|

866 |

|

||||

|

Intercompany (a) |

|

|

(833 |

) |

|

|

(798 |

) |

|

|

(1,590 |

) |

|

|

(1,513 |

) |

||||

|

Total |

|

$ |

|

3,946 |

|

|

$ |

|

3,739 |

|

|

$ |

|

7,642 |

|

|

$ |

|

7,250 |

|

|

Internal Revenue Growth |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

Period-to-Period Change for the |

|

Period-to-Period Change for the |

||||||||||||||||||||||||

|

Three Months Ended |

Six Months Ended |

||||||||||||||||||||||||||

|

June 30, 2019 vs. 2018 |

June 30, 2019 vs. 2018 |

||||||||||||||||||||||||||

|

|

|

|

|

As a % of |

|

|

|

|

As a % of |

|

|

|

|

As a % of |

|

|

|

|

As a % of |

||||||||

|

|

|

|

|

Related |

|

|

|

|

Total |

|

|

|

|

Related |

|

|

|

|

Total |

||||||||

|

|

Amount |

|

Business(b) |

|

Amount |

|

Company(c) |

|

Amount |

|

Business(b) |

|

Amount |

|

Company(c) |

||||||||||||

|

Collection and disposal |

$ |

87 |

|

|

2.7 |

% |

|

|

|

|

|

|

$ |

169 |

|

|

2.7 |

% |

|

|

|

|

|

||||

|

Recycling commodities |

|

(41 |

) |

|

(14.2 |

) |

|

|

|

|

|

|

|

(66 |

) |

|

(11.3 |

) |

|

|

|

|

|

||||

|

Fuel surcharges and mandated fees |

|

2 |

|

|

1.1 |

|

|

|

|

|

|

|

|

7 |

|

|

2.3 |

|

|

|

|

|

|

||||

|

Total average yield (d) |

|

|

|

|

|

$ |

48 |

|

|

1.3 |

% |

|

|

|

|

|

|

$ |

110 |

|

|

1.5 |

% |

||||

|

Volume |

|

|

|

|

|

|

146 |

|

|

4.0 |

|

|

|

|

|

|

|

|

263 |

|

|

3.7 |

|

||||

|

Internal revenue growth |

|

|

|

|

|

|

194 |

|

|

5.3 |

|

|

|

|

|

|

|

|

373 |

|

|

5.2 |

|

||||

|

Acquisitions |

|

|

|

|

|

|

59 |

|

|

1.6 |

|

|

|

|

|

|

|

|

116 |

|

|

1.6 |

|

||||

|

Divestitures |

|

|

|

|

|

|

(40 |

) |

|

(1.2 |

) |

|

|

|

|

|

|

|

(82 |

) |

|

(1.2 |

) |

||||

|

Foreign currency translation |

|

|

|

|

|

|

(6 |

) |

|

(0.2 |

) |

|

|

|

|

|

|

|

(15 |

) |

|

(0.2 |

) |

||||

|

Total |

|

|

|

|

|

$ |

207 |

|

|

5.5 |

% |

|

|

|

|

|

|

$ |

392 |

|

|

5.4 |

% |

||||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Period-to-Period Change for the |

|

|

Period-to-Period Change for the |

|

||||||

|

Three Months Ended June 30, 2019 vs. 2018 |

Six Months Ended June 30, 2019 vs. 2018 |

|||||||||||

|

|

|

As a % of Related Business(b) |

|

|

As a % of Related Business(b) |

|

||||||

|

|

|

Yield |

|

Volume |

|

|

Yield |

|

Volume(e) |

|

||

|

Commercial |

|

2.3 |

% |

2.7 |

% |

|

2.3 |

% |

2.5 |

% |

||

|

Industrial |

|

4.2 |

|

1.2 |

|

|

|

4.2 |

|

2.1 |

|

|

|

Residential |

|

3.3 |

|

(0.4 |

) |

|

|

3.5 |

|

(0.5 |

) |

|

|

Total collection |

|

3.0 |

|

1.7 |

|

|

|

3.1 |

|

1.9 |

|

|

|

MSW |

|

3.6 |

|

6.1 |

|

|

|

3.5 |

|

6.0 |

|

|

|

Transfer |

|

3.4 |

|

6.5 |

|

|

|

3.1 |

|

7.3 |

|

|

|

Total collection and disposal |

|

2.7 |

|

4.4 |

|

|

|

2.7 |

|

4.3 |

|

|

| __________________________ | |

| (a) |

Intercompany revenues between lines of business are eliminated in the Condensed Consolidated Financial Statements included herein. |

| (b) |

Calculated by dividing the increase or decrease for the current year period by the prior year period’s related business revenue adjusted to exclude the impacts of divestitures for the current year period. |

| (c) |

Calculated by dividing the increase or decrease for the current year period by the prior year period’s total Company revenue adjusted to exclude the impacts of divestitures for the current year period. |

| (d) |

The amounts reported herein represent the changes in our revenue attributable to average yield for the total Company. |

| (e) |

Workday adjusted volume impact. |

| WASTE MANAGEMENT, INC. | ||||||||||||||

| SUMMARY DATA SHEET | ||||||||||||||

| (In Millions) | ||||||||||||||

| (Unaudited) | ||||||||||||||

| Free Cash Flow (a) | ||||||||||||||

|

Three Months Ended |

|

Six Months Ended |

||||||||||||

|

|

|

|

|

June 30, |

|

June 30, |

||||||||

|

|

|

|

|

2019 |

|

2018 |

|

2019 |

|

2018 |

||||

| Net cash provided by operating activities |

$ |

1,010 |

$ |

975 |

$ |

1,900 |

$ |

1,784 |

||||||

| Capital expenditures |

|

(578) |

|

(436) |

|

(1,049) |

|

(836) |

||||||

| Proceeds from divestitures of businesses | ||||||||||||||

| and other assets (net of cash divested) |

|

8 |

|

82 |

|

20 |

|

96 |

||||||

| Free cash flow |

$ |

440 |

$ |

621 |

$ |

871 |

$ |

1,044 |

||||||

|

Three Months Ended |

|

Six Months Ended |

||||||||||||

|

|

|

|

|

June 30, |

|

June 30, |

||||||||

|

|

|

|

|

2019 |

|

2018 |

|

2019 |

|

2018 |

||||

| Supplemental Data | ||||||||||||||

| Internalization of waste, based on disposal costs |

|

66.6% |

|

66.1% |

|

66.4% |

|

65.7% |

||||||

| Landfill amortizable tons (in millions) |

|

32.5 |

|

29.7 |

|

60.4 |

|

55.9 |

||||||

| Acquisition Summary (b) | ||||||||||||||

| Gross annualized revenue acquired |

|

14 |

|

10 |

|

119 |

|

168 |

||||||

| Total consideration , net of cash acquired |

|

41 |

|

17 |

|

435 |

|

266 |

||||||

| Cash paid for acquisitions consummated during the period, | ||||||||||||||

| net of cash acquired |

|

40 |

|

15 |

|

431 |

|

258 |

||||||

| Cash paid for acquisitions including contingent consideration | ||||||||||||||

| and other items from prior periods, net of cash acquired |

|

48 |

|

21 |

|

442 |

|

269 |

||||||

| Amortization, Accretion and Other Expenses for Landfills: |

Three Months Ended |

|

Six Months Ended |

|||||||||||

|

June 30, |

|

June 30, |

||||||||||||

|

2019 |

|

2018 |

|

2019 |

|

2018 |

||||||||

| Landfill amortization expense: | ||||||||||||||

| Cost basis of landfill assets |

$ |

133 |

$ |

113 |

$ |

243 |

$ |

213 |

||||||

| Asset retirement costs |

|

28 |

|

33 |

|

45 |

|

53 |

||||||

| Total landfill amortization expense |

|

161 |

|

146 |

|

288 |

|

266 |

||||||

| Accretion and other related expense |

|

25 |

|

25 |

|

50 |

|

49 |

||||||

| Landfill amortization, accretion and other related expense |

$ |

186 |

$ |

171 |

$ |

338 |

$ |

315 |

||||||

|

(a) |

The summary of free cash flow has been prepared to highlight and facilitate understanding of the principal cash flow elements. Free cash flow is not a measure of financial performance under generally accepted accounting principles and is not intended to replace the consolidated statement of cash flows that was prepared in accordance with generally accepted accounting principles. |

|

|

(b) |

Represents amounts associated with business acquisitions consummated during the applicable period except where noted. |

| WASTE MANAGEMENT, INC. | |||||||||||||||

| RECONCILIATION OF CERTAIN NON-GAAP MEASURES | |||||||||||||||

| (In Millions, Except Per Share Amounts) | |||||||||||||||

| (Unaudited) | |||||||||||||||

| Three Months Ended June 30, 2019 |

|||||||||||||||

| Income from Operations |

Pre-tax Income (a) |

Tax Expense |

Net Income (b) |

Diluted Per Share Amount |

|||||||||||

| As reported amounts |

$ |

696 |

$ |

496 |

$ |

115 |

$ |

381 |

$ |

0.89 |

|||||

| Adjustments: | |||||||||||||||

| Loss on early extinguishment of debt | _ |

|

84 |

|

20 |

|

64 |

|

0.15 |

||||||

| Non-cash charges to write-off certain assets |

|

23 |

|

23 |

|

6 |

|

17 |

|

0.04 |

|||||

| Advanced Disposal acquisition-related costs (c) |

|

6 |

|

9 |

|

1 |

|

8 |

|

0.03 |

|||||

| As adjusted amounts |

$ |

725 |

$ |

612 |

$ |

142 |

$ |

470 |

$ |

1.11 |

|||||

| Depreciation and amortization |

|

409 |

|||||||||||||

| Adjusted operating EBITDA |

$ |

1,134 |

|||||||||||||

| Three Months Ended June 30, 2018 |

|||||||||||||||

| Income from Operations |

Pre-tax Income |

Tax Expense |

Net Income (b) |

Diluted Per Share Amount |

|||||||||||

| As reported amounts |

$ |

715 |

$ |

609 |

$ |

110 |

$ |

499 |

$ |

1.15 |

|||||

| Adjustments: | |||||||||||||||

| Benefit primarily related to the gain on divestiture of an ancillary business |

|

(38) |

|

(38) |

|

(10) |

|

(28) |

|

(0.07) |

|||||

| Tax benefit related to income tax audit settlements | _ | _ |

|

33 |

|

(33) |

|

(0.07) |

|||||||

| As adjusted amounts |

$ |

677 |

$ |

571 |

$ |

133 |

$ |

438 |

$ |

1.01 |

|||||

| Depreciation and amortization |

|

384 |

|||||||||||||

| Adjusted operating EBITDA |

$ |

1,061 |

|||||||||||||

| 2019 Projected Free Cash Flow Reconciliation (d) | |||||||||||||||

|

Scenario 1 |

|

Scenario 2 |

|||||||||||||

| Net cash provided by operating activities |

$ |

3,675 |

$ |

3,775 |

|||||||||||

| Capital expenditures |

|

(1,750) |

|

(1,750) |

|||||||||||

| Proceeds from divestitures of businesses and | |||||||||||||||

| other assets (net of cash divested) |

|

100 |

|

50 |

|||||||||||

| Free cash flow |

$ |

2,025 |

$ |

2,075 |

|||||||||||

| ___________________________________________________________ | |

| (a) |

Pre-tax income excludes $1 million related to net income attributable to noncontrolling interests. |

| (b) |

For purposes of this press release table, all references to "Net income" refer to the financial statement line item "Net income attributable to Waste Management, Inc." |

| (c) |

Includes impact of reducing our common stock repurchases in 2019 from planned levels due to the pending acquisition of Advanced Disposal Services, Inc. ("Advanced Disposal"). |

| (d) |

The reconciliation includes two scenarios that illustrate our projected free cash flow range for 2019. The amounts used in the reconciliation are subject to many variables, some of which are not under our control and, therefore, are not necessarily indicative of actual results. |

|

|

|

| WASTE MANAGEMENT, INC. | ||||||||||||

| RECONCILIATION OF CERTAIN NON-GAAP MEASURES | ||||||||||||

| (In Millions, Except Per Share Amounts) | ||||||||||||

| (Unaudited) | ||||||||||||

| Three Months Ended | ||||||||||||

| June 30, 2019 | June 30, 2018 | |||||||||||

| Adjusted Operating Expenses and Adjusted Operating Expenses Margin | Amount | As a % of Revenues |

Amount | As a % of Revenues |

||||||||

| Operating revenues, as reported |

$ |

3,946 |

$ |

3,739 |

||||||||

| Operating expenses, as reported |

$ |

2,443 |

61.9 |

% |

$ |

2,313 |

61.9 |

% |

||||

| Adjustment: | ||||||||||||

| Non-cash charges to write-off certain assets |

|

16 |

||||||||||

| Adjusted operating expenses |

$ |

2,427 |

61.5 |

% |

||||||||

| Three Months Ended | ||||||||||||

| June 30, 2019 | June 30, 2018 | |||||||||||

| Adjusted Selling, General & Administrative (SG&A) Expenses and Adjusted SG&A Margin | Amount | As a % of Revenues |

Amount | As a % of Revenues |

||||||||

| Operating revenues, as reported |

$ |

3,946 |

$ |

3,739 |

||||||||

| SG&A expenses, as reported |

$ |

391 |

9.9 |

% |

$ |

365 |

9.8 |

% |

||||

| Adjustment: | ||||||||||||

| Advanced Disposal acquisition-related costs |

|

6 |

||||||||||

| Adjusted SG&A expenses |

$ |

385 |

9.8 |

% |

||||||||

View source version on businesswire.com: https://www.businesswire.com/news/home/20190725005367/en/

Source:

Waste Management

Web site

www.wm.com

Analysts

Ed Egl

713.265.1656

eegl@wm.com

Media

Andy Izquierdo

832.710.5287

aizquierdo@wm.com